What Does Non Profit Organizations List Mean?

Table of ContentsThe Ultimate Guide To Google For NonprofitsTop Guidelines Of 501 CThe Greatest Guide To Npo RegistrationHow Non Profit Organizations Near Me can Save You Time, Stress, and Money.Not known Facts About Non Profit Organization ExamplesGetting My Non Profit Organization Examples To WorkThe Greatest Guide To Google For NonprofitsEverything about 501c3 NonprofitFacts About Not For Profit Organisation Revealed

Incorporated vs - not for profit organisation. Unincorporated Nonprofits When individuals think about nonprofits, they typically think about bundled nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and other formally produced organizations. Nevertheless, lots of individuals take part in unincorporated nonprofit organizations without ever recognizing they've done so. Unincorporated not-for-profit organizations are the result of 2 or even more individuals teaming up for the function of supplying a public benefit or service.Private foundations might consist of family foundations, private operating foundations, and also company foundations. As kept in mind over, they commonly don't provide any kind of solutions and instead make use of the funds they elevate to sustain various other charitable organizations with service programs. Private structures also often tend to require more start-up funds to develop the company in addition to to cover lawful costs and also various other continuous costs.

The 8-Minute Rule for Irs Nonprofit Search

The possessions remain in the count on while the grantor is alive as well as the grantor might handle the assets, such as buying and also offering stocks or realty. All assets transferred into or purchased by the count on continue to be in the count on with earnings distributed to the assigned beneficiaries. These trust funds can endure the grantor if they consist of a stipulation for recurring monitoring in the documents utilized to develop them.

The Buzz on Non Profit Organization Examples

You can hire a count on attorney to help you develop a charitable trust and also suggest you on exactly how to handle it relocating ahead. Political Organizations While a lot of various other forms of not-for-profit companies have a limited ability to join or supporter for political activity, political organizations run under various guidelines.

3 Easy Facts About 501 C Described

As you examine your choices, make sure to seek advice from with an attorney to identify the ideal method for your company and also to ensure its proper configuration.

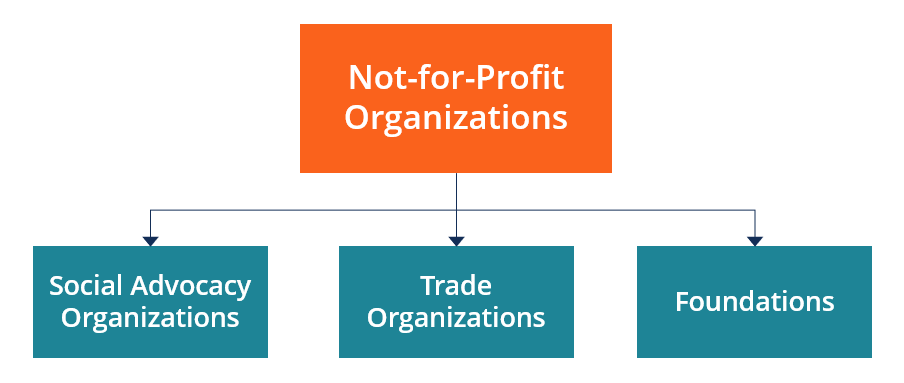

There are numerous types of not-for-profit organizations. All possessions and income from the not-for-profit are reinvested into the company or donated.

An Unbiased View of Non Profit Organizations List

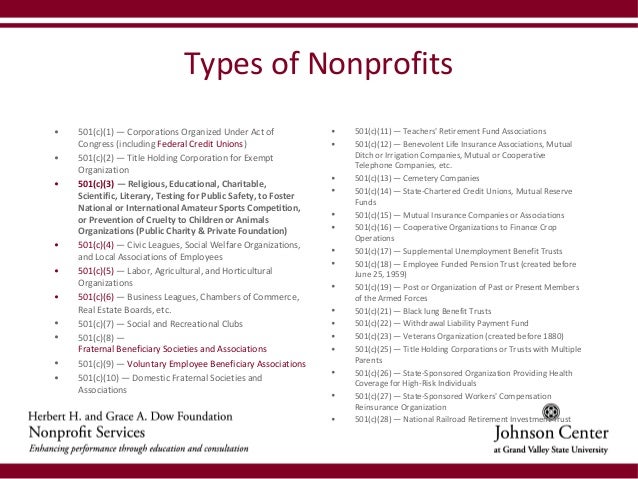

In the United States, there are around 63,000 501(c)( 6) companies. Some examples of popular 501(c)( 6) companies are the American Farm Bureau, the National Writers Union, as well as the International Association of Fulfilling Planners. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or leisure clubs. The function of these nonprofit organizations is to organize activities that lead to pleasure, leisure, as well as socialization.

Excitement About Non Profit Org

Usual income sources are membership fees and contributions. 501(c)( 14) - State Chartered Debt Union as well as Mutual Book Fund 501(c)( 14) are state chartered credit score unions and also mutual get funds. These organizations provide economic solutions to their members and also the area, commonly at discounted prices. Resources of revenue are business tasks as well as federal government grants.

In order to be eligible, a minimum of 75 percent of members have to exist or past members of the USA Armed Forces. Funding originates from contributions and government grants. 501(c)( 26) - State Sponsored Organizations Providing Health Coverage for High-Risk Individuals 501(c)( 26) are not-for-profit companies produced at the state degree to give insurance for high-risk people that might not have the ability to get insurance through other methods.

The 501c3 Nonprofit PDFs

Funding originates from contributions or federal government gives. Instances of not for profit corporation states with these risky insurance policy swimming pools are North Carolina, Louisiana, as well as Indiana. 501(c)( 27) - State Sponsored Workers' Settlement Reinsurance Company 501(c)( 27) not-for-profit companies are created to give insurance for employees' settlement programs. Organizations that supply employees compensations are required to be a member of these organizations and pay fees.

A nonprofit corporation is a company whose function is something other than making a profit. 5 million nonprofit companies registered in the US.

An Unbiased View of Non Profit Org

No one person or team has a not-for-profit. Assets from a nonprofit can be marketed, but it profits the whole company instead of people. While any person can check my blog include as a nonprofit, just those that pass the rigid criteria set forth by the government can attain tax excluded, or 501c3, condition.

We discuss the actions to ending up being a not-for-profit more into this page.

The Greatest Guide To Non Profit Organizations Near Me

One of the most important of these is the capacity to get tax obligation "exempt" status with the internal revenue service, which permits it to obtain contributions totally free of gift tax, permits contributors to deduct donations on their revenue tax obligation returns and also spares some of the organization's activities from revenue tax obligations. Tax obligation excluded condition is essential to numerous nonprofits as it urges donations that can be utilized to sustain the mission of the organization.